The 20-Second Trick For Financial Education

Wiki Article

Some Known Facts About Financial Education.

Table of ContentsThe Ultimate Guide To Financial EducationFacts About Financial Education UncoveredSee This Report about Financial EducationThe Ultimate Guide To Financial EducationThe smart Trick of Financial Education That Nobody is DiscussingFinancial Education for BeginnersSome Known Questions About Financial Education.Indicators on Financial Education You Should KnowUnknown Facts About Financial Education

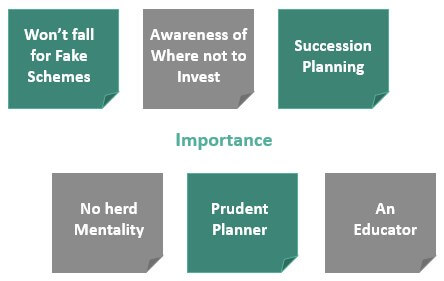

Financial proficiency is necessary due to the fact that it equips us with the understanding and also abilities we need to manage cash effectively. Without it, our economic decisions as well as the activities we takeor do not takelack a solid foundation for success. Best Nursing Paper Writing Service. And this can have alarming effects: Given the above data, it might not be unusual that nearly two-thirds of Americans can't pass a standard examination of economic literacy.With each other, the populations they serve period a wide range of ages, revenues, and also backgrounds. These educators witness first-hand the influence that financial literacyor the absence of financial literacycan have on a person's life.

What Does Financial Education Mean?

Our team is honored to be producing a brand-new standard within greater education by bringing the subject of money out of the shadows. "Financial resources inherentlywhether or not it's exceptionally temporary in simply buying lunch for that day or lasting saving for retirementhelp you complete whatever your objectives are.Every year given that the TIAA Institute-GFLEC study started, the ordinary percent of concerns responded to properly has increasedfrom 49% in 2017 to 52% in 2020. While there's more work to be done to enlighten consumers concerning their financial resources, Americans are relocating the ideal instructions. The goal of financial literacy is to establish a sensation of control over your finances while also using money as a device to freely make selections that construct better life fulfillment, according to a 2015 report by the Consumer Financial Protection Bureau (CFPB).

The Main Principles Of Financial Education

Do not let the concern of leaping right into the economic world, or a feeling that you're "just not good with money," prevent you from improving your financial understanding. There are little actions you can take, and also sources that can help you in the process. To start, capitalize on complimentary devices that may already be offered to you.Numerous banks and Experian likewise offer cost-free credit report tracking. You can utilize these tools to get a first grasp of where your cash is going and also where you stand with your debt. Find out whether the company you function for offers totally free economic therapy or a worker financial health program.

Getting My Financial Education To Work

With an excellent or outstanding credit report, you can get reduced rates of interest on loans and debt cards, credit rating cards with eye-catching and money-saving rewards, as well as a series of offers for monetary products, which provides you the opportunity to pick the most effective bargain. However to boost credit rating, you need to understand what aspects add to your rating. Best Nursing Paper Writing Service.This brand-new circumstance is resulting in higher unpredictability in the financial setting, in the monetary markets and also, obviously, in our very own lives. Neither need to we fail to remember that the dilemma resulting from the pandemic has actually checked the of agents and also families in the.

All about Financial Education

As we stated earlier, the pandemic has actually likewise boosted making use of electronic channels by citizens that have actually not constantly been electronically as well as economically encouraged. Furthermore, there are likewise sectors of the populace that are less acquainted with technical breakthroughs and are as a result at. Adding to this issue, following the pandemic we have actually additionally seen the decrease of physical branches, specifically in backwoods.Among the best presents that you, as a parent, can provide your kids is the money talk. As well as much like keeping that various other talk, tweens and teenagers aren't constantly find out responsive to what moms and dads have to saywhether it's concerning approval or compound interest. As teenagers become extra independent as well as think regarding life after high college, it's simply as essential for them to find out regarding economic literacy as it is to do their own laundry.

Financial Education for Beginners

Discovering how to make sound cash choices currently will help offer teens the confidence to make better choices tomorrow. Financial literacy can be defined as "the capacity to make use of expertise as well as abilities to handle financial resources properly for a life time of economic health." In brief: It's understanding how to save, grow, and also safeguard your cash.And like any kind of ability, the earlier you discover, the even more proficiency you'll get. There's no much better location to talk concerning practical cash abilities than in your home, so children can ask questionsand make mistakesin a risk-free room. No one is a lot more interested in youngsters' financial futures than their parents.

See This Report on Financial Education

While teenagers are instructed elements of financial proficiency at institution, they might likewise take in inaccurate information from pals, peers, or other adults in their lives with bad money-management skills. As grownups, we understand the distinction between what we require (food, a place to live, apparel) and also what we desire (supersize cappucinos, an exotic vacation, the current phone).

By showing children concerning cash, you'll assist them discover exactly how to stabilize wants and needs without going into financial obligation. Older teenagers might intend to go on a trip with pals, yet with also Going Here a little financial literacy, they'll recognize that this is a "desire" they may require to spending plan as well as conserve for.

The Ultimate Guide To Financial Education

Does the idea of your teenager hitting the mall or shopping online with a charge card in their name fill you with dread? Speaking about credit scores is vital in helping tweens and also teenagers recognize the relevance image source of money as well as the effects of making poor monetary decisions. If your teenager requests a charge card, as opposed to giving an automatic "no," assist them understand that it's not free cash.

Some Known Factual Statements About Financial Education

Report this wiki page